7 Common Commission Issues That Staffing Industry Faces (and How to Solve Them)

Executive Summary: When it comes to commission calculation, the staffing industry faces problems like splitting of placement fees, clawback adjustment, keeping track of large datasets, etc. This article explores these common challenges in detail and features ways you can solve them.

Every industry has commission calculation issues. The staffing industry, in particular, struggles with challenges like splitting placement fees, delays in commission payment due to certain caveats, team-based revenue targets, and more.

While these issues are common, not every agency has found the perfect solution.

Agencies that use spreadsheets to manage commissions should consider using commission automation software to tackle these issues. These can make calculations easier and error-free and bring more transparency to the entire process.

In this article, we’ll cover the most common commission challenges that staffing agencies face. You’ll also find some fantastic benefits of using commission software and a perfect alternative to spreadsheets.

In the staffing industry, commission management can present its own unique set of challenges. Here are seven common commission challenges faced by staffing agencies:

Staffing companies often split the placement fee based on three factors:

Here the split could be complex if the staffing agency owns the client, but they referred to other agencies for candidates. Conversely, they could refer their own candidates to other clients.

This results in a split of the placement fees between the involved parties. And that’s why you need to keep multiple data here, like the source of each client and candidate, split ratio, and more. This can quickly snowball with the increasing number of candidates, clients, and salespersons involved in the equation.

The commission rate could vary depending on if the candidate is on a temporary or permanent placement.

When a candidate receives a permanent placement, salespeople typically earn an upfront fee. This fee could come with its own stipulations, such as the candidate having to spend at least three months before the commission will be credited.

This again requires the staffing agency to keep track of this due date and ensure that they send the invoice to the client on time. Once they receive the commission amount, they have to add it to the total commission the salesperson will receive.

The payment of commission becomes more complex when the candidate is placed on a temporary or contractual basis.

Let’s quickly see what these challenges are:

These conditions put the commission earned into limbo.

And maintaining data like commission amount, start date, and other information on a spreadsheet can be a hassle. Plus, there’s no way to track each date except by going through it manually.

Sounds exhausting? We know!

Commission clawback in staffing and recruiting is a provision under which if a placement fails, then the client fee has to be refunded. This means the staffing agency needs to deduct or claw back the paid commission amount from the future commissions of the salesperson.

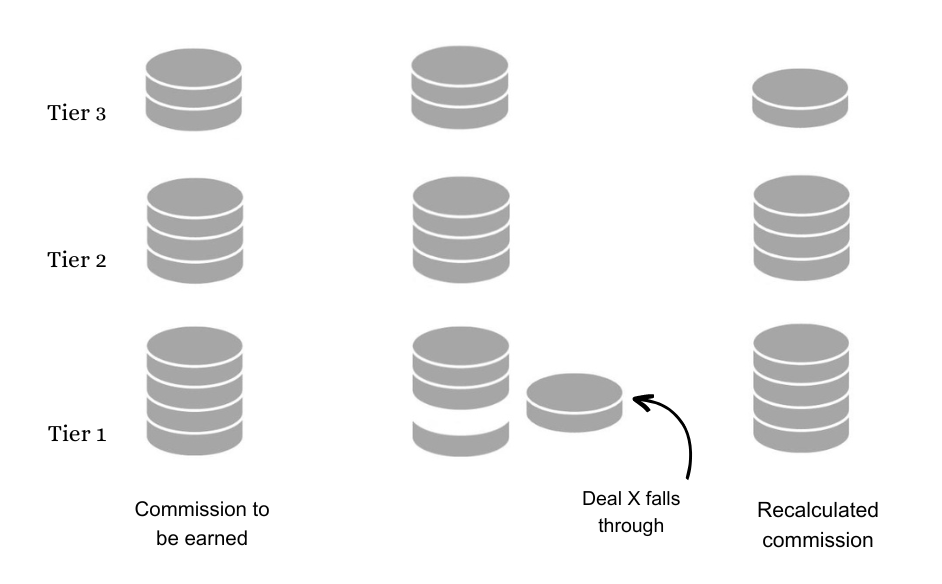

This situation can easily become tricky if the staffing agency follows a tiered commission structure.

How?

Imagine each deal is placed one on top of another – creating a stack. The higher you are on the stack, the more commission rate you earn. Now, if you remove a block from the bottom, the tower automatically shifts down.

So, suppose a salesperson was supposed to earn commission based on these tiers:

However, the entire commission needs to be recalculated as deal X fell through. For some deals that were initially calculated at 15% now, the commission will be calculated at 12%.

Some agencies offer a signing bonus to the salesperson to motivate them to close a deal.

While this allows the sales rep to immediately see the monetary impact of closing the deal, it can create cash flow problems for the agency if there's a significant delay between the signed agreement and the first payment.

Moreover, if this amount is a significant portion of the compensation package, it may require adjustments to commission rates, quotas, or targets to maintain the desired balance between fixed and variable pay.

The demanding nature of staffing agency work involves a lot of team effort and hierarchies.

So, to compensate each rep, you need to determine the appropriate split ratios. This can depend on factors like each team member's level of involvement, contribution, or responsibility.

You also need to consider the changing team dynamics. Sales representatives may join or leave the team, or the team structure may evolve based on project requirements or client demands. Managing commission splits effectively amidst these changes requires flexibility and adaptability in the commission calculation process.

Lastly, one of the biggest challenges that the staffing industry faces is scalability.

For each placement, the staffing industry needs to keep track of the following:

Now, add hundreds of candidates to this equation. *inaudible gasp*

Exactly!

This makes correctly mapping and tracking the placement data to the right sales all the more complicated.

So what can you do?

Look for a solution that helps you automate commission calculation, take of stipulations like clawbacks, and also nudge you when it’s time for payouts,

And commission software can help you do just that!

With its advanced features and capabilities, commission software can help overcome the commission disputes faced by staffing agencies in their commission management processes.

Let's take a closer look at how commission software addresses these challenges and provides practical solutions for staffing agencies.

Where can you find such a tool?

Luckily, ElevateHQ ticks all the boxes!

ElevateHQ is a commission automation tool suitable for small to medium-sized businesses. It offers some amazing features like:

In the fast-paced world of staffing agencies, effectively managing commissions is crucial for driving sales performance and motivating sales reps.

However, placement fee splits, clawbacks, team-based revenue targets, and other complexities in the commission calculations pose significant challenges.

This is where commission software like ElevateHQ emerges as a game-changer.

Sign up for ElevateHQ’s free demo and transform commission management today!