Is Sales Commission Taxed?

Executive summary:

Sales commissions are a crucial component of compensation. However, the taxation of sales commissions can be a complex topic. In this blog post, we'll explore the fascinating world of sales commission taxation, diving into the IRS's treatment of commissions as supplemental income and the different taxation methods. We'll also provide industry benchmarks and examples to show how sales commission taxation works. So, let's unravel the mysteries and gain a deeper understanding!

Sales commissions fall under supplemental income, alongside bonuses, overtime pay, and severance packages. According to the IRS, supplemental income is considered an additional earning on top of an individual's regular salary or wages. This means that sales commissions are subject to taxation, just like other forms of supplemental income.

Employers can structure their compensation plans differently, affecting how sales commissions are taxed. Let's explore two common methods:

In this method, employers combine all types of income, including sales commissions, into a single income. Regular state and federal taxes are then withheld based on the employee's tax bracket.

Alternatively, employers may treat sales commissions as supplemental income separately. Under this approach, sales commissions are not combined with the regular income but are treated as a distinct category. The IRS applies specific tax rates to supplemental income.

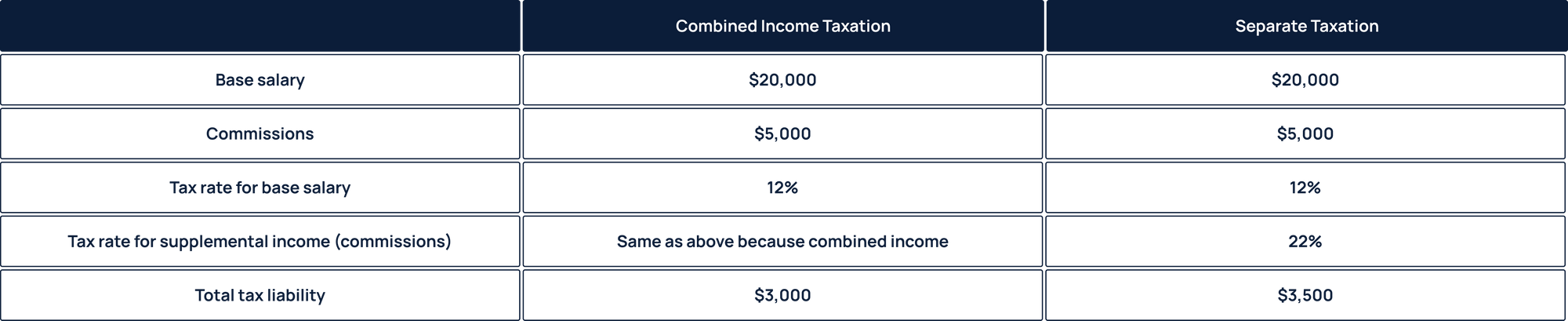

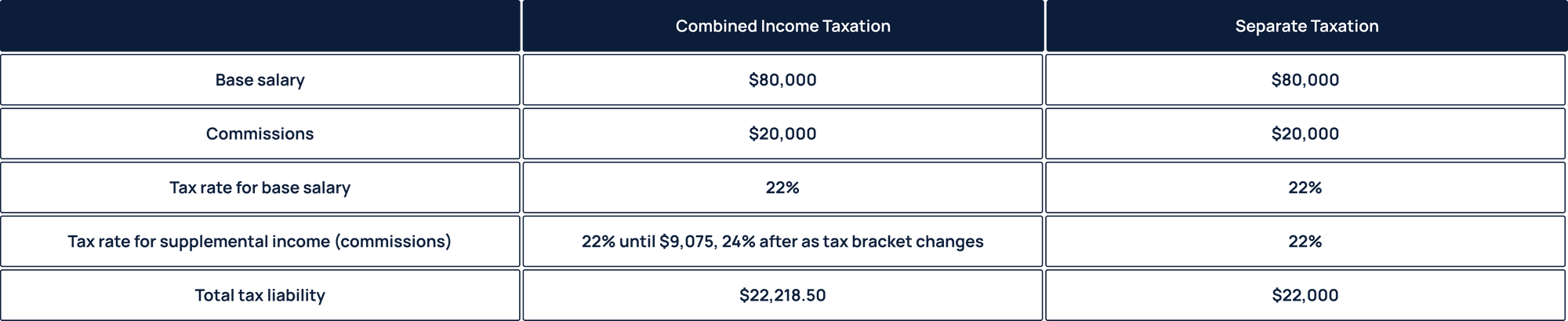

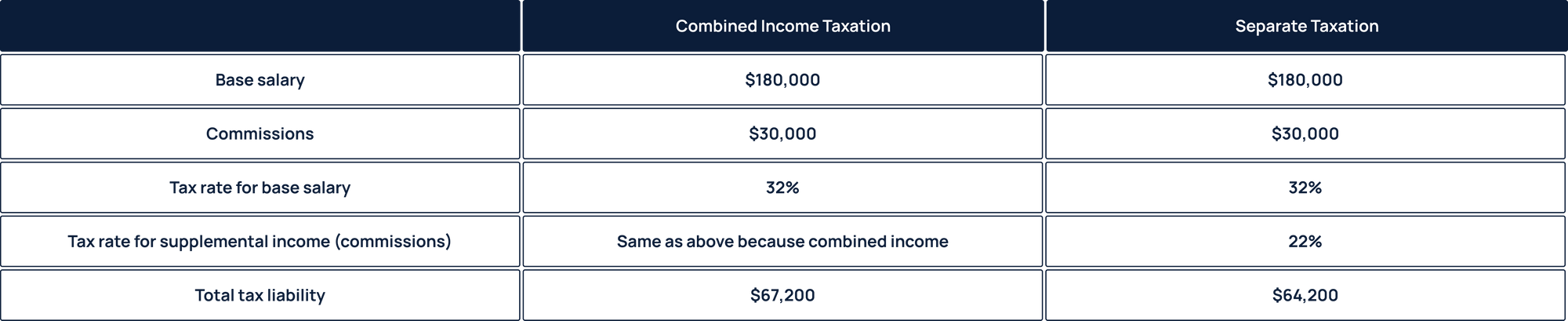

Let's look at a few examples:

Lower-income:

Medium-income:

High-income:

We can see that the combined income approach has a lower tax liability for lower incomes, while the separate taxation approach has a lower tax liability for higher incomes.

Navigating the taxation of sales commissions requires a solid understanding of the IRS's treatment of commissions as supplemental income and the various taxation methods employed. Remember to consult with tax professionals and stay updated with the latest regulations to ensure accurate reporting and compliance.